Counterfeiting in the Electronics Industry: A threat to innovation and safety

Counterfeit goods infiltrate global markets and supply chains, jeopardizing the reliability of critical components and placing both manufacturers and consumers at risk. As the consumer electronics market continues to grow, combating counterfeiting is essential to sustaining innovation, ensuring safety, and protecting brand value in this dynamic sector.

This article explores the challenges posed by counterfeit consumer electronics, examines the scale of the market, and outlines effective solutions tailored to address this pressing issue.

The Electronics Market: A rapidly growing sector

The electronics market is a cornerstone of modern economies, encompassing a wide range of products tailored to diverse needs and applications. To better understand its structure, it is important to distinguish between three main categories: consumer electronics, general electronics market, and electrical appliances.

The consumer electronics market refers to devices and gadgets designed for everyday personal use, aimed at enhancing productivity, communication, and entertainment. Key segments include telephony (e.g., smartphones and feature phones), TV, radio, and multimedia (e.g., televisions, radios, speakers, and headphones), computing devices (e.g., laptops, desktops, and tablets), TV peripheral devices (e.g., streaming devices and smart remotes), drones, and gaming equipment (e.g., consoles and VR headsets).

Wearables, such as smartwatches, fitness trackers, and hearables, have emerged as a rapidly growing subcategory within consumer electronics. These devices are increasingly popular due to their integration of health monitoring, activity tracking, and advanced connectivity features. Driven by rising consumer interest in health and fitness, as well as advancements in IoT and AI technologies, wearables represent a significant driver of growth in the consumer electronics market.

The general electronics market comprises all electronic products outside the scope of consumer electronics. This includes essential components such as circuit boards, resistors, and semiconductors, as well as network/telephone hardware like routers, switches, and servers. Industrial electronics, including automation systems and control panels, also fall into this category, highlighting its significance in infrastructure and business operations.

The electrical appliances market focuses on household and utility devices. Major household appliances include washing machines, refrigerators, ovens, and freezers. Smaller appliances such as microwaves, hand mixers, and toasters are also part of this segment. Additionally, electrical parts designed for higher voltage applications (e.g., 230V), such as fuses, transformers, and wiring components, are integral to the functionality and safety of these appliances. Utility devices like electricity meters, wall boxes for electric vehicle charging, and HVAC systems also play a critical role. These components, used in both major and small appliances, emphasize the technical complexity and essential nature of the electrical appliances market.

The Consumer Electronics Market

In this blog article, we will however only focus on the consumer electronics market, exploring its key segments, trends and the challenges it faces in combating counterfeiting.

In 2024, the global consumer electronics market generated approximately $950 billion in revenue, with projections indicating a compound annual growth rate (CAGR) of 2.90%. Telephony, which includes smartphones, feature phones, and landline phones, remains the largest segment, with a market volume of $486.7 billion, followed by computing devices at $217.6 billion. It is predicted that by 2024, online sales will account for 33.5% of the total revenue in this market.

The refurbished electronics market is also experiencing exponential growth as affordability and sustainability take centre stage. The refurbished electronics market contains electronic devices returned to the manufacturer or seller for various reasons, including problems or customer discontent. These products are then fixed, tested, and returned to their original state, before being offered again at a lesser price than new products. Globally, the market was valued at $47.57 billion in 2023 and is projected to grow at a CAGR of 10.03%, reaching $123.71 billion by 2033 In Europe, 30% of mobile phones in circulation are now refurbished, a steep increase from just 5% in 2015. Companies like Back Market, Refurbed and Swappie are leading the charge in this space, promoting circular economies while meeting consumer demand for cost-effective devices.

Key Players in the Consumer Electronics Market

Leading companies in the consumer electronics market focus on innovation, cost efficiency and market expansion to maintain a competitive edge. These players invest in advanced technologies and sustainable practices to meet consumer demands and grow their market share.

Leading companies include:

- Samsung (South Korea)

- Sony (Japan)

- LG Electronics (South Korea)

- Philips (EU)

- Panasonic (Japan)

- Apple (U.S.)

- HP (U.S.)

- Huawei (China)

Regional Highlights

Asia Pacific dominates the consumer electronics market, generating $293.74 billion in revenue in 2023 with a 37.98% market share. This growth is driven by robust consumer demand in countries like China and India, rising disposable incomes, and strong export demand for Asian-manufactured electronics. The region’s leadership is supported by major players like Samsung, Sony, Panasonic, and LG. Additionally, Chinese companies play a pivotal role in the industry’s dominance. Foxconn (Hon Hai Precision Industry), a key manufacturer for global brands like Apple, reported revenues of approximately $198.32 billion in 2023, underscoring its influence on the global supply chain. Similarly, Huawei, a leader in consumer electronics and telecommunications, achieved revenues exceeding $98.5 billion in 2023, reflecting its continued growth and innovation in the sector.

The significant contributions of these Chinese manufacturers, alongside other major brands, highlight Asia-Pacific’s central role in shaping the global consumer electronics landscape.

In Europe, the market is expected to reach €176.8 billion in revenue by 2024. The Telephony segment (smartphones, feature phones and landline phones) is the largest, accounting for €75.5 billion. This segment’s growth is fuelled by increasing demand for mobile devices that enable communication and provide access to the internet. Additionally, online sales represent 32.5% of total revenue, highlighting the region’s significant adoption of e-commerce. Germany leads the way with strong demand for high-quality and sustainable consumer electronics, reflecting a broader shift toward eco-friendly innovation. Prominent brands in the European market include Philips and Logitech, known for their advanced product offerings and focus on sustainability.

In the United States, the consumer electronics market is projected to generate approximately $149.6 billion in revenue in 2024, with the Telephony segment accounting for $62.1 billion. This growth is propelled by leading companies such as Apple, GoPro, and Sonos, which continue to drive innovation and consumer demand. Online sales are expected to contribute 50% of the total revenue, reflecting a significant shift toward e-commerce channels. The U.S. market’s focus on premium devices and cutting-edge technology ensures its continued competitiveness and global influence.

Consumer Electronics Market Trends

The growing adoption of connected homes and smart devices is transforming the consumer electronics market. Multifunctional appliances equipped with features like voice assistance, Bluetooth and Wi-Fi connectivity are increasingly popular for their convenience and versatility. To meet this demand, companies are making significant investments in research and development, driving innovation in artificial intelligence (AI) and smart technologies.

Advanced virtual assistants such as Amazon Alexa, Google Assistant and Apple Siri are at the forefront of this evolution. These systems use AI and natural language processing (NLP) to understand and respond to voice commands with remarkable accuracy, delivering a seamless user experience. Through machine learning, these assistants continuously adapt to user preferences, improving their ability to provide personalized recommendations, contextual understanding and predictive insights.

This AI-powered functionality enables smart speakers to go beyond simple voice commands, offering enhanced capabilities like tailored entertainment options, efficient smart home control, and predictive task management. As consumers increasingly rely on voice-enabled devices for applications ranging from home automation to productivity tools, the integration of AI and virtual assistants is set to drive the demand for smart speakers and propel the market’s growth in the years ahead.

Challenges in the consumer electronics market

The consumer electronics market faces several challenges that could hinder its growth. The increasing pace of technological advancements creates pressure on manufacturers to innovate rapidly, shortening product lifecycles and raising R&D costs. This fast-paced environment forces companies to continually update their offerings to stay competitive.

Supply chain complexity is another major issue. Electronics manufacturing depends on globally sourced components, making it vulnerable to disruptions such as geopolitical tensions, trade restrictions and raw material shortages. For instance, the semiconductor shortage has significantly impacted production timelines and increased costs. The COVID-19 pandemic further exacerbated these challenges, causing widespread delays in production and logistics due to factory shutdowns, transportation bottlenecks and workforce shortages.

Sustainability demands present additional hurdles. Consumers now expect environmentally friendly products, but meeting these expectations requires substantial investment in sustainable materials and manufacturing practices. Companies must balance environmental responsibility with maintaining profitability.

Furthermore, the issue of e-waste management and recycling has become increasingly critical. As electronic devices have shorter lifespans, the amount of discarded electronics, or e-waste, continues to grow rapidly. According to recent statistics, the global e-waste volume reached 62 million metric tons in 2022 and is projected to increase up to 82 million tonnes by 2030. Alarmingly, less than 23% of this waste was properly recycled in 2022, leaving $62 billion worth of recoverable natural resources unaccounted for and contributing to pollution. Hazardous substances like mercury in e-waste pose significant health risks, including brain damage and coordination issues. Without intervention, recycling rates are projected to drop further by 2030. Governments worldwide are introducing stricter regulations and legislation to encourage recycling and proper disposal of e-waste, pressuring manufacturers to adopt circular economy practices. This includes designing products that are easier to recycle and investing in take-back programs to manage the lifecycle of their products responsibly.

Sustainability demands also pose challenges. Consumers now expect environmentally friendly products, but meeting these expectations requires substantial investment in sustainable materials and manufacturing practices. Companies must balance environmental responsibility with maintaining profitability.

Lastly, the rise of counterfeit goods adds another layer of complexity, eroding trust in legitimate brands and challenging their ability to maintain product integrity. Especially supply chain disruptions from Covid-19 provided counterfeiters with new opportunities to exploit gaps in supply chains, leading to an increase in the circulation of fake consumer electronics. Though solutions are emerging, such as advanced authentication methods, the fight against counterfeiting is far from over.

The growing threat of counterfeit electronics

The rapid growth of the global consumer electronics market, particularly in the refurbished segment, has attracted counterfeiters eager to exploit its complexities. Counterfeit goods infiltrate supply chains and marketplaces, creating significant challenges for manufacturers, distributors and consumers. The sector’s reliance on intricate supply chains further underscores its vulnerability, making regulatory oversight and innovation essential to maintaining market integrity.

These fake products are often manufactured with substandard materials, lacking the quality control and safety checks of legitimate production. As a result, counterfeit batteries may overheat and catch fire, while fake microchips can fail in critical systems, such as medical devices or automotive safety features. Such risks not only endanger consumers but also damage the reputations of legitimate brands when counterfeit goods are mistaken for authentic ones.

Economically, counterfeiting siphons billions of dollars from legitimate manufacturers, diverting resources from research and development and harming industry innovation. Counterfeit goods also erode consumer trust by saturating markets with low-quality imitations that tarnish a brand’s reputation. Additionally, counterfeit components can infiltrate legitimate supply chains, leading to costly recalls and jeopardizing the reliability of industries that depend on precision, such as aerospace, automotive, and telecommunications.

This growing sophistication of counterfeiters, combined with the global nature of electronics supply chains, leads to a lot of complex challenges with counterfeits for consumer electronic brands.

The following real-world examples really highlight this issue:

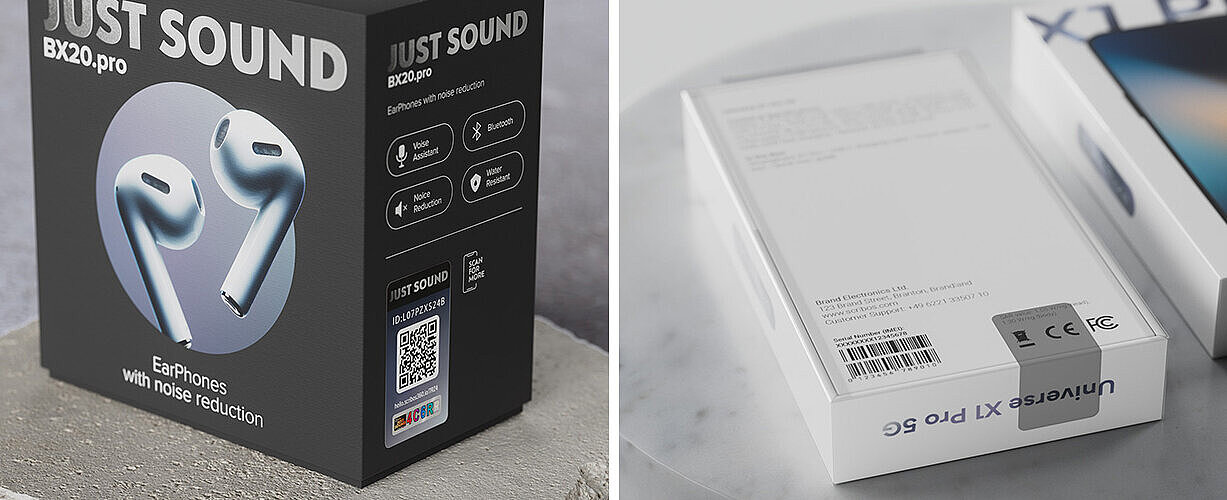

- Apple: In October 2024, two individuals defrauded Apple of approximately $2.5 million by importing counterfeit iPhones from Hong Kong and exploiting Apple’s warranty system to exchange them for genuine devices. This scam not only cost Apple millions but also exposed vulnerabilities in their warranty process, demonstrating how counterfeit products can infiltrate even robust corporate systems. Earlier in February 2024, Chinese authorities dismantled a massive counterfeit AirPods operation in Suining, Sichuan Province, seizing fake products valued at approximately $23.5 million. These incidents underscore the extensive reach of counterfeit electronics and their ability to undermine consumer trust and brand integrity.

Counterfeit earphones, such as fake AirPods, also pose broader concerns. Poor sound calibration in these products has been linked to hearing damage, while substandard components increase risks of electrical short circuits and other safety hazards. Performance issues, including unreliable sound quality and poor connectivity, further frustrate consumers, who are left without warranty or support for defective products. Moreover, counterfeit earphones contribute to e-waste, as their inferior materials lead to faster breakage and disposal, creating additional environmental challenges.

- Beats by Dre: Counterfeit Beats headphones have long posed a significant issue, with fake products flooding both online and physical marketplaces. In 2013, Beats headphones were reported to be the most counterfeited product globally, reflecting the massive scale of the issue at the time. These fake products, often made with substandard materials and inferior sound quality, misled buyers into believing they were purchasing premium products. The prevalence of such counterfeit operations significantly harmed the brand’s reputation to this day and diverted millions of dollars from legitimate sales.

- Samsung: In early 2024, Hong Kong customs officials seized over HK$10 million worth of counterfeit Samsung and Apple electronics, including fake smartphones and accessories. The operation led to multiple arrests and highlighted the challenges of monitoring global supply chains.

- Icom: In September 2024, a series of deadly explosions in Lebanon were linked to counterfeit walkie-talkies bearing the branding of Japanese manufacturer Icom. These devices, which lacked authenticity seals, were rigged with explosives, resulting in numerous casualties. This incident highlighted the extreme dangers posed by counterfeit electronics in conflict zones. Furthermore, it underscored an additional issue: the vulnerabilities of older electronics. Older electronic models are often targeted for counterfeiting because their original manufacturers may no longer produce them or have ceased supporting them with updates and parts. This creates a demand for counterfeit replacements in critical applications, where outdated electronics are still in use. These older models are more susceptible to tampering and may bypass modern quality controls, posing significant risks. This case demonstrates how counterfeiters exploit gaps in the market, putting both consumers and larger systems at risk.

The examples above demonstrate that counterfeit electronics are far from a trivial issue — they represent a complex and multifaceted danger. From exposing vulnerabilities in warranty systems to infiltrating global supply chains and even compromising critical infrastructure, counterfeit goods have far-reaching consequences. These products not only jeopardize consumer safety and brand reputation but also pose significant risks to national security and economic stability. The cases involving Apple, Samsung, Cisco, and Icom underscore the urgency of addressing this issue with robust anti-counterfeiting measures and stricter oversight to protect consumers, businesses, and critical systems worldwide.

How brands can combat counterfeiting in electronics

Security Labels

Security labels are a powerful tool for combating counterfeiting in the electronics industry. With advanced anti-counterfeiting and grey market protection features, these labels allow consumers to verify product authenticity quickly and effortlessly, building trust and confidence in the brand — even before making a purchase. Manufactured with proprietary technologies, they offer unparalleled protection, with no successful imitation attempts over the past two decades. Every label is 100% serialized and integrates overt, semi-overt, and covert features, ensuring seamless authentication for all stakeholders.

Security Seals

Security seals safeguard electronic products and packaging by providing tamper-evident protection. Featuring an irreversible void effect, these seals clearly display prior opening, deterring unauthorized access and fraud. Even attempts to reseal the product cannot hide this first-opening effect. These seals are particularly important for online purchases, where the risk of receiving a counterfeit product in an original-looking package is significantly higher. Security seals help consumers verify the integrity of their product upon delivery, offering an added layer of trust.

Customisable to fit any shape or surface, SCRIBOS HighPerSeal offers a transparent version that ensures product information remains visible, aligning with a brand’s packaging design and corporate identity. Sustainable options, like paper-based seals, further enhance security while supporting eco-friendly practices.

Printed Security

Printed security solutions like SCRIBOS’ ValiGate® Direct Print integrate advanced anti-counterfeiting features directly onto packaging or labels, offering a scalable and sustainable solution for high-volume products. This tamper-proof marking embeds a patented security pattern within a QR code, ensuring it cannot be copied or reverse-engineered. Consumers can authenticate products effortlessly without requiring additional apps, while brands benefit from actionable data to track and remove counterfeits from the market. This solution not only protects products but also opens opportunities for customer interaction and market analysis.

Holographic Security

Holographic security combines digital and optical features into a single solution, offering a sophisticated layer of protection for electronics. SCRIBOS’ ValiGate® Zoom integrates patented technology into holographic designs, enabling instant authentication using a smartphone without additional tools or training. This innovative solution enhances security and seamlessly integrates with existing manufacturing workflows. With its visually appealing and highly secure design, holographic security strengthens consumer trust and deters counterfeiters.

The Power of Consumer Involvement

Consumers play a crucial role in the fight against counterfeit electronics. By empowering them with tools to verify authenticity, brands can create a collaborative defence against counterfeiting while enhancing customer trust. SCRIBOS’ solutions enable consumers to authenticate their purchases using their smartphones through a quick and reliable process, without requiring additional apps. This not only protects consumers from counterfeits but also shields them from potential hazards, such as safety risks and product malfunctions associated with fake goods.

A single copy-proof QR code or security label on a product’s packaging can streamline the verification process while offering access to a range of additional resources. Once authenticated, customers can view e-leaflets, product information, user manuals, installation and instruction videos or links to social media channels. These resources improve the user experience and promote informed product usage. Sustainability and recycling information can also be included, encouraging environmentally responsible practices and aligning with growing consumer demand for eco-friendly solutions.

At the same time, brands can elevate consumer engagement by integrating features such as bonus point systems, warranty extensions, and web shop links. These incentives create a more interactive and rewarding customer journey, fostering loyalty and long-term trust. Additionally, this approach provides brands with valuable insights into counterfeiting hotspots and unauthorized sales channels, enabling them to take proactive measures against counterfeit threats. By combining authentication with enhanced consumer interaction, brands can protect their products while deepening connections with their customers.

Conclusion

Counterfeiting in the electronics industry is a critical challenge that undermines innovation, compromises safety, and erodes consumer trust. The growing complexity of global supply chains and the increasing sophistication of counterfeiters have made this issue more urgent than ever. From life-threatening incidents to economic losses, counterfeit electronics present risks that extend from individual consumers to national security.

Fortunately, the industry is not without solutions. Advanced anti-counterfeiting technologies — such as security labels, holographic seals, or printed security — offer robust tools to protect products and supply chains. These measures deter counterfeiters while empowering consumers to verify the authenticity of their purchases, creating a collaborative defence against fake goods. At the same time, companies can integrate eco-friendly solutions to align anti-counterfeiting efforts with sustainability goals, addressing consumer demand for environmentally responsible practices. By doing so, brands can enhance product integrity, safeguard their reputation, and build long-term customer loyalty.

SCRIBOS has already successfully partnered with leading brands to implement effective solutions against counterfeiting. For example, Bose and Sennheiser have leveraged SCRIBOS’ expertise to protect their premium products, ensuring consumer trust in their high-value electronics. Even Microsoft, during its time in the mobile phone market, utilized SCRIBOS’ SecuritySeal to safeguard its packaging, illustrating how customized solutions can be tailored to meet the specific needs of different product lines. These successful implementations demonstrate SCRIBOS’ ability to deliver innovative and trusted brand protection strategies.

As regulatory frameworks evolve, initiatives like the Digital Product Passport (DPP) will play an increasingly critical role. Initially piloted in areas such as batteries — an extended category of consumer electronics — DPP regulations aim to improve transparency, sustainability, and traceability across product lifecycles. These regulations present a significant opportunity for brands to integrate compliance with SCRIBOS’ brand protection solutions. For example, a single copy-proof QR code can enable product verification, provide recycling and sustainability information, and meet DPP requirements seamlessly. This streamlined approach benefits both consumers and manufacturers by simplifying processes, ensuring compliance, and strengthening trust.

To combat counterfeiting effectively, the industry must adopt a multi-pronged approach that combines technological innovation, regulatory oversight, and consumer involvement. By prioritizing these strategies, electronics manufacturers can safeguard their markets, preserve the integrity of critical systems, and drive sustainable growth in this dynamic sector. The fight against counterfeit electronics is not just about protecting products — it’s about securing the future of innovation and trust in the electronics industry.